Biofertilizers Market Growth Driven by Sustainable Farming & Organic Food Demand at a CAGR of 12.6% | DataM Intelligence

Biofertilizers Market is expanding as sustainable agriculture practices organic food demand, and government support drive adoption across global farming sectors

CALIFORNIA, CA, UNITED STATES, September 16, 2025 /EINPresswire.com/ -- The global biofertilizers market reached USD 2.56 billion in 2022 and is projected to grow to USD 6.65 billion by 2031, registering a strong CAGR of 12.6% during 2024-2031. This expansion is underpinned by rapid adoption of sustainable agricultural practices, rising preference for chemical-free crop production, and robust government support especially in regions with large agricultural sectors like Asia-Pacific.What are Biofertilizers?

Biofertilizers are natural substances containing living microorganisms (such as bacteria, fungi, and algae) that enhance nutrient availability and promote plant growth by enriching the soil’s microbiome. Unlike synthetic fertilizers, biofertilizers foster better soil health, increase water retention, and reduce the environmental footprint of farming. They are especially prized in organic and regenerative agriculture.

Book an Executive Sample PDF: Benchmark Competitor Biofertilizers Market Strategies: https://www.datamintelligence.com/download-sample/bio-fertilizers-market

Key Market Drivers

• Demand for Chemical-Free Agriculture: Consumers are seeking foods produced with fewer chemicals, and regulations are tightening for synthetic fertilizer use in many countries.

• Growth in Organic Farming: According to India’s National Programme of Organic Production, organic acreage and output continue to expand—fueling demand for eco-friendly biofertilizers.

• Government Policies and Support: Subsidies and initiatives—such as India’s NMOOP and specific subsidies for bacterial and mycorrhizal inoculants—help farmers transition to biofertilizer use.

• Soil Health and Yield: Biofertilizers such as mycorrhiza enhance plant nutrient uptake (notably phosphorus), bolster natural plant defenses, and contribute to higher crop yields and resilience.

Market Challenges

• Production Costs: Biofertilizers often require specialized equipment, controlled environments, and careful storage due to shorter shelf life raising costs compared to conventional fertilizers.

• Quality Variability and Shelf Life: The efficacy of biofertilizers depends on strain quality, formulation, and storage, making standardization and supply chain integrity crucial.

• Logistics and Distribution: Efficient distribution, proper storage, and farmer awareness are necessary to maintain product viability and adoption rates.

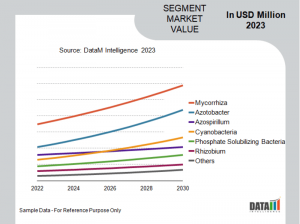

Market Segments and Leading Products

• By Microorganism Type: Mycorrhiza-based biofertilizers are the most widely adopted due to their effectiveness in improving phosphorus uptake and plant disease resistance.

• By Crop/Application: Biofertilizers are used in cereals, pulses, oilseeds, horticulture, and even turf management (sports, forestry), reflecting versatile benefits.

• By Region: Asia-Pacific leads the market, buoyed by India, China, and Australia’s vast cropland and government-driven adoption. India’s agricultural policies and Australia’s 427 million hectares of farmland drive regional dominance.

• Form and Channel: Products are marketed as carrier-based solids or liquids and distributed through agri-input retailers, cooperatives, and producer organizations.

Major Companies and Recent Developments

Key players include Katyani Organics, Peptech Biosciences, Novozymes, UPL, Chr. Hansen, Lallemand, IPL Biologicals, Gujarat State Fertilizers & Chemicals, BioWorks, and T.Stanes and Co.

Strategic launches such as Bionema’s turf products in the UK and partnerships like TERI’s "Uttam Superrhiza" highlight advances in practical, application-specific biofertilizer products.

Mergers & Acquisition Activity: Corteva’s acquisition of Symborg and global expansion strategies by established agri-input players underscore a competitive, innovative sector.

United States: Recent Industry Developments

✅ In September 2025, Novozymes launched next-gen microbial biofertilizers for corn and soybean, improving soil health and crop yield.

✅ In August 2025, Marrone Bio Innovations introduced multi-strain biofertilizers for sustainable vegetable farming.

✅ In July 2025, BioConsortia expanded production of nitrogen-fixing microbial inoculants for cereal crops.

✅ In June 2025, Indigo Ag partnered with U.S. farms to deploy plant microbiome-based biofertilizers for improved drought tolerance.

✅ In May 2025, Symborg USA introduced phosphate-solubilizing biofertilizers enhancing nutrient uptake efficiency.

Looking for in-depth insights? Grab the full report: https://www.datamintelligence.com/buy-now-page?report=bio-fertilizers-market

Europe: Recent Industry Developments

✅ In September 2025, BASF Europe launched eco-friendly microbial biofertilizers for cereals and high-value crops.

✅ In August 2025, Eurofins BioAg expanded its biofertilizer testing and formulation services for EU farmers.

✅ In July 2025, Biocontrol Europe introduced multi-functional biofertilizers enhancing plant immunity and soil microbiome.

✅ In June 2025, Valagro developed microbial consortia-based biofertilizers targeting precision agriculture applications.

✅ In May 2025, Compo Expert Europe launched enhanced liquid biofertilizers for sustainable horticulture.

Japan: Recent Industry Developments

✅ In September 2025, Sumitomo Chemical expanded its biofertilizer offerings for rice and vegetable cultivation.

✅ In August 2025, Nichino Co. launched microbial inoculants for improving soil nutrient cycling in domestic farms.

✅ In July 2025, JCAM Fertilizer developed plant-growth-promoting biofertilizers for specialty crops.

✅ In June 2025, Mitsubishi Corporation partnered with local farms to deploy eco-friendly biofertilizers in horticulture.

✅ In May 2025, Takii & Co. advanced R&D on biofertilizers integrating nitrogen-fixing bacteria for sustainable agriculture.

Regional Analysis

• Asia-Pacific: The largest market share, enabled by huge agricultural land, growing organic movement, and proactive government involvement.

• North America: Fastest growing market due to increasing organic farming and growing regulatory scrutiny on synthetic fertilizer use.

• Europe and Latin America: Steady growth fueled by organic food demand, sustainable agriculture subsidies, and consumer awareness.

Conclusion

Biofertilizers are central to the sustainable transformation of agriculture, balancing crop productivity with environmental stewardship. As quality, standardization, and access improve and regulatory/consumer emphasis shifts toward sustainability the global biofertilizers market is positioned for robust growth through 2031. Ongoing investment, technological innovation, and strong policy frameworks will further accelerate industry adoption and effectiveness.

Get Corporate Access to Live Biofertilizers Industry Intelligence Database: https://www.datamintelligence.com/reports-subscription

Related Reports:

Fertilizer Market reached US$210.5 billion in 2022 and is projected to witness lucrative growth by reaching up to US$308.6 billion by 2030. The market is growing at a CAGR of 4.9% during the forecast period 2024-2031

Fertilizer Mixtures Market is forecasted to reach at a CAGR of 9.23% during the forecast period (2023-2030).

Sai Kumar

DataM Intelligence 4market Research LLP

877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.